Which of the Following Professional Services Is an Attestation Engagement

An engagement to report on managements discussion and analysis MDA would be considered an attest engagement because the accountant is issuing an examination review or agreed-upon procedures report on another partys assertion. Attest engagements include those in which a practitioner is engaged to issue.

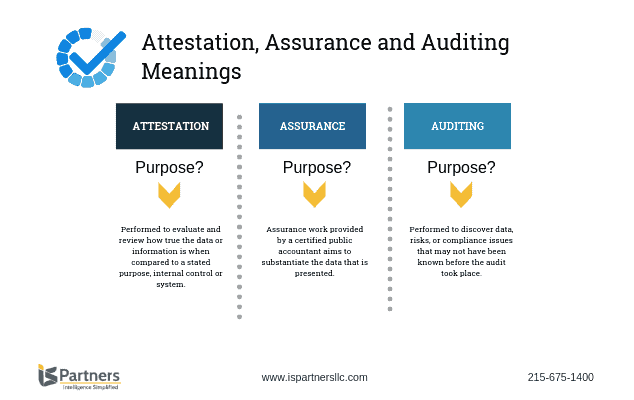

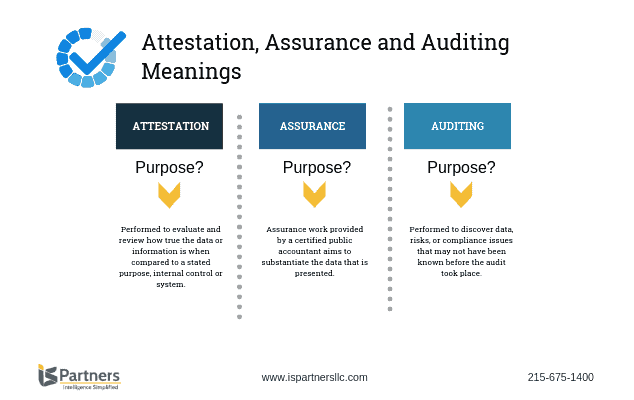

Defining Attestation Auditing Assurance I S Partners Llc

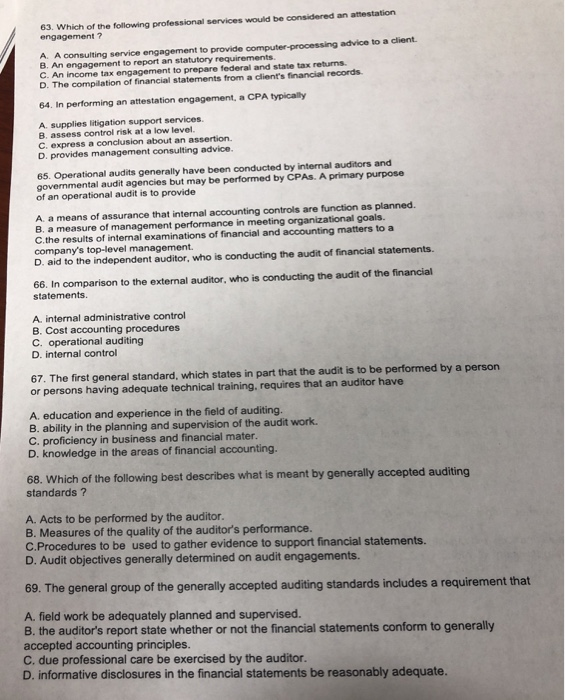

2 An engagement to report on compliance with statutory requirements.

. Which of the following professional services would be considered an attest engagement. Which of the following professional services would be considered an attestation engagementA. An engagement to report on compliance with statutory requirements.

Providing financial analysis planning and capital acquisition services as a part-time in-house controller. What professional services is an attestation engagement. Which of the following professional services is an attestation engagement.

Tax engagements in which a practitioner is engaged to prepare tax returnsorprovidetaxadvice 05 An attest engagement may be part of a larger engagementfor ex- amplea feasibility study or business acquisition study may also include an examinationofprospectivefinancialinformationInsuchcircumstancesthese. Risk-free interest rate business risk and information risk. Which of the following professional services is an attestation engagement.

Which of the following professional services is an attestation engagement. Examinations reviews or agreed-upon procedure reports. A consulting service engagement to provide computer-processing advice to a client B.

Advocating on behalf of a client about trust tax matters. 1 A consulting service engagement to provide computer-processing advice to a client 2 An engagement to report on compliance with statutory requirements 3 An income tax engagement to prepare federal and state tax returns 4 The preparation of financial statements from a. Which of the following professional services would be considered an attestation engagement.

1 A consulting service engagement to provide computer-processing advice to a client 2 An engagement to report on compliance with statutory requirements 3 An income tax engagement to prepare federal and state tax returns. An engagement to report on compliance with statutory requirements. Audit of financial statements.

Distinguish among the following three risks. Preparing the income statement and balance sheet for one year in the future based on client expectations and predictionsC. 1 A consulting service engagement to provide computer processing advice to a client.

Which of the following professional services is an attestation engagement. 2 An income tax engagement to prepare federal and state tax returns. An engagement to report on compliance with statutory requirements.

Attestation engagements specifically exclude advocacy services and consulting services. In performing attestation services a CPA will normally. These services can be used to gain assurance over the following subject matters.

3 An engagement to report on compliance with statutory requirements. The compilation of an engagement to provide a peer review for another CPA firm. Which of the following professional services is considered an attestation engagement.

Choice b is incorrect. Which of the following professional services would be considered an attestation engagement. Choice a is incorrect.

Choices a and d are incorrect. A consulting service engagement to provide computer-processing advice to a client. Discuss the major factors in todays society that have made the need for independent audits much greater than it was 50 years ago.

An income tax engagement to prepare federal and state tax returns. A consulting service engagement to provide computer-processing advice to a client. Of the following which is the broadest concept.

Chapter 1 Explain the relationships among audit services attestation services and assurance services and give examples of each. An income tax engagement to prepare federal and state tax returns. Compilation review and audit.

A consulting service engagement to provide computer-processing advice to a client. Which of the following professional services would be considered an attestationengagement1 Advocating on behalf of a client about trust tax matters under review by theInternal Revenue Service2 Providing financial analysis planning and capital acquisition services as apart-time in-house controller3 Advising management in the selection of a computer system to meet. Which of the following professional services is an attestation engagement.

In accounting an attestation service or engagement is the process of engaging a CPA to provide assurance or attestation audits over services such as. Which of the following professional services is an attestation engagement. A consulting service engagement to provide computer advice to a client.

Agreed-upon procedures prospective financial statements compliance. Improve the quality of information or its context for decision makers. Which of the following professional services is an attestation engagement.

An income tax engagement to prepare federal and state tax returns. A An income tax engagement to prepare federal and state tax returns B An engagement to report on compliance with statutory requirements C A consulting service. 1 A management consulting engagement to provide IT advice to a client.

Preparing future financial statements constitutes a compilation of prospective financial statements which is considered to be an attestation service. A management consulting engagement to provide computerized advice to a client. An income tax engagement to prepare federal and state tax returns.

Choice b is correct. Advocating on behalf of a client about trust tax matters under review by the Internal Revenue Service. An engagement to report on compliance with statutory requirements.

Recommend uses for information. There are three types of attestation services. Attestation Engagements The audit of financial statements is the most common attestation service but there are several others like agree-upon procedures engagements review and examination engagements.

An income tax engagement to prepare federal and state tax returns. Advising management in the selection of a computer system to meet business needsB. An engagement to report an statutory requirements.

The compilation of financial statements from a. An enagement to report on compliance with statutory requirementsObjectives 1-1 1-3 1-5.

Attestation Services Engagements Examples Audits Standards

Ch 21 Assurance Attestation And Internal Auditing Services Flashcards Quizlet

Solved 63 Which Of The Following Professional Services Chegg Com

Comments

Post a Comment